As a wealth advisor with over 15 years of experience in the industry, I’m here to tell you that you do not need to plot, plan, and outsmart the market. Sometimes this approach is even detrimental to your overall portfolio. Here is why—and what you can do instead if you want to be a successful investor.

We’ve all come across the legend of someone who hit it big thanks to a hot stock tip. But, despite what you may have heard, choosing companies based on short-term momentum can be risky. While it may work sometimes, more often than not market trends can change quickly and lead to unexpected losses. If you rely on momentum alone without considering a company’s underlying health and future profitability, you may be more vulnerable to short-term market fluctuations.

On the other hand, choosing investments with strong fundamentals and long-term potential can provide a more stable foundation. Companies with solid financials and growth potential tend to handle market volatility better. Despite the temptation for quick gains, a balanced approach considering both short-term trends and long-term stability can help you better weather these market fluctuations.

Not only does outsmarting the market involve timing when to buy in, but you also have to time when to sell. That means for every gain, you have to be right twice to make timing the market worth it. Unfortunately, market moves can only truly be spotted in hindsight, and outsmarting the market is often closer to playing the lottery than it is to an educated guess.

One way you can be a successful investor is by simply relying on time in the market instead of timing the market. The longer you stay invested in a particular asset, the more likely you are to experience growth over the long term. Considering the S&P 500 Index has averaged around 9.4% for the last 50 years, this strategy doesn’t seem all that bad. Buying and holding can result in much lower stress and a more secure investment experience for the average investor over the long term.

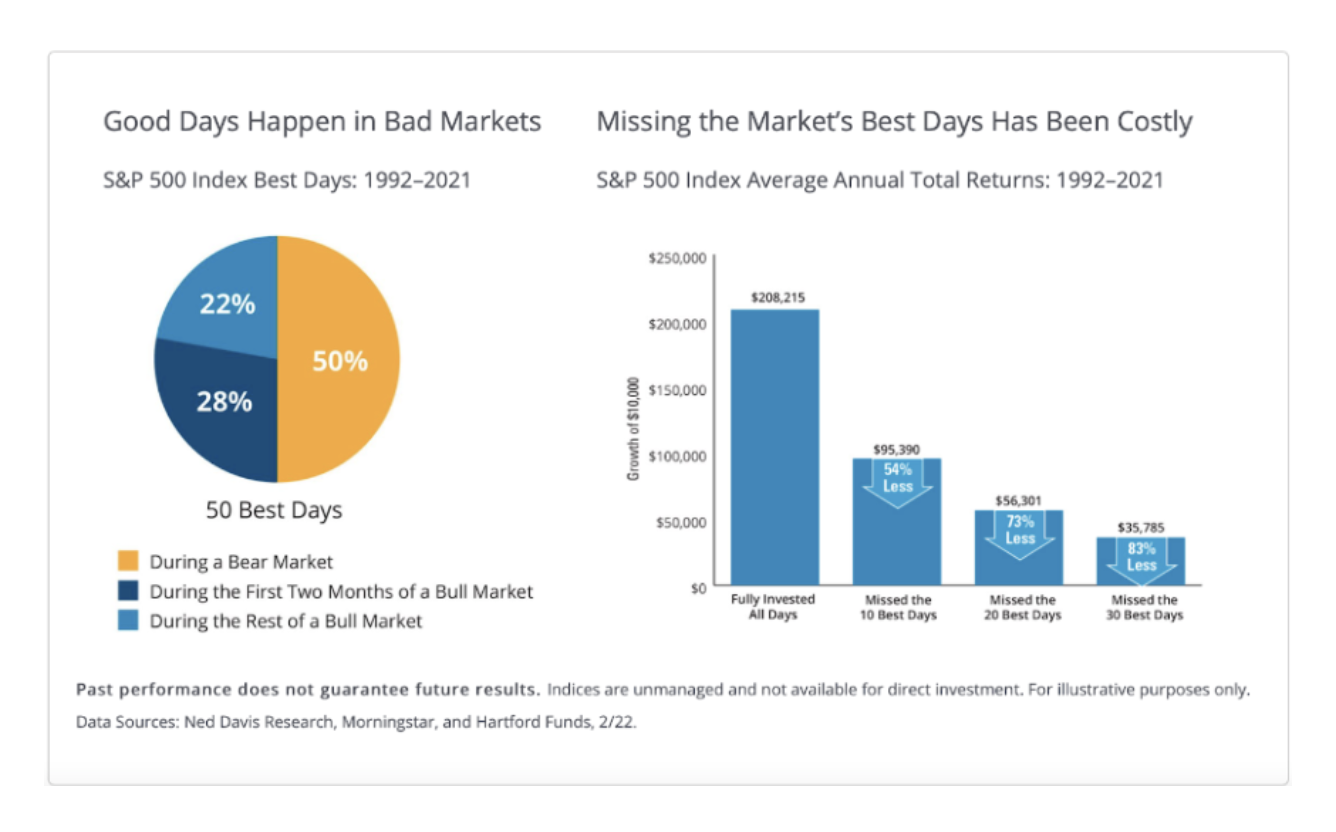

This graph by Hartford Funds and Morningstar shows what happens if you miss the best days in the market, which often closely follow a major downturn and can be just as difficult to predict. An investor who missed the 10 best days in the market between 1992 and 2021 would have earned 54% less than someone who was fully invested during the same time period.

Someone who missed the 30 best market days would have earned a whopping $172,000 (83%) less than their fully invested counterpart. The research is based on a $10,000 initial investment, but these numbers would be much more dramatic if you were dealing with a $100,000 or even a $1,000,000 portfolio.

Trying to outsmart the market has been around just as long as the market itself, and though it rarely works, many people keep trying. Not only are you less likely to outperform the market through market timing, but you could further reduce your returns depending on how often you trade. That’s because outsmarting the market can be expensive.

Depending on your account type, asset class, and where you are executing your trades, you could be charged for every purchase and sale you make, and that’s on top of any taxes owed on gains. The more frequently you trade, the higher your transaction costs will be.

If you hold the assets for less than a year, your gain will be taxed as ordinary income at your marginal tax rate, which can be as high as 37%.

Even if you find an actively managed fund that can beat the market, they have to do so by a wide enough margin to cover its higher costs and more. As such, even some funds that beat the market end up with lower returns once fees are taken into account. This is why it can be a much safer and successful strategy to ride the wave of stock market volatility.

Many investors will sell their positions during times of volatility to avoid or reduce a loss. But how do they know when to buy back in? This is one of the most difficult aspects of outsmarting the market, and it can lead to much less growth than staying invested the whole time would have produced.

For instance, a recent study by Schwab Center for Financial Research found that bad market timing is worse than investing immediately, regardless of the market conditions at the time of investing. This indicates that even in market downturns, or just before a downturn, investors who invest immediately and remain invested will be better off than those who stay on the sidelines or attempt to time the market.

The time value of money tells us that a dollar today is worth more than a dollar tomorrow, and this is certainly the case when it comes to investing. The longer you are invested, the more likely you are to ride out the fluctuations of the day-to-day market and experience growth.

Attempting to time the market can be equivalent to trying to win the lottery. The market is unpredictable and often takes everyone by surprise. Why take your chances? We believe that a successful investment strategy involves tuning out the noise and staying focused on your long-term goals instead.

At Wealth Advocate Group, we advocate for what is most important to you. We provide financial education, meticulous planning, and clear guidance for your family and your future. If you are ready to work with a trusted financial partner to help you design a strong long-term investment strategy that can ride out the waves of the market, reach out today. Call 440-505-5751 or email jcohen@Wadvocate.com to schedule an appointment.

Jason Cohen is Chief Operating Officer and wealth advisor at Wealth Advocate Group, LLC, an independent, fee-based wealth management company. Jason has 15 years of experience and spends his days managing firm operations, including portfolio trading and analysis, training new advisors, financial plan production, and client relationship management. Jason specializes in serving real estate professionals and other independent contractor business owners, helping them navigate their unique financial challenges, such as unpredictable cash flow and tax issues, so they can pursue financial independence. Jason has a bachelor’s degree in public management from Indiana University and is a CERTIFIED FINANCIAL PLANNER® professional and believes that everyone should have access to comprehensive financial planning. He is passionate about doing his best for his clients and setting others up for success. Outside of the office, you can find Jason staying active in a variety of sports and spending time with friends and family. Learn more about Jason by connecting with him on LinkedIn.

When you link to any of the websites mentioned, we make no representation as to the completeness or accuracy of information provided at these websites. The opinions found therein are those of the author(s) of the article or website.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.