The period leading up to retirement can be a challenging and daunting time. You may feel a mix of emotions, including excitement about embarking on a new phase of life, anxiety about how to make it a reality, and uncertainty about navigating the complexities of the Social Security process.

Understanding how Social Security works, the benefits available, and the eligibility requirements is crucial for anyone planning for retirement or managing their finances. In this comprehensive guide, we’ll cover everything you need to know about Social Security, from how it is calculated to the various programs and benefits available, as well as some strategies for optimizing your Social Security benefits.

Your Social Security benefits are calculated by the Social Security Administration (SSA). Benefits are based on lifetime earnings across your 35 highest earning years. You must work a minimum of 10 years to be eligible for benefits. If you have worked less than 35 years, your earnings will be calculated with zeros for the years you have not worked. All past wages are indexed to today’s wages in order to accurately reflect wage growth.

Once your average monthly earnings for your top 35 years are calculated, a special formula is applied and the result is your primary insurance amount (PIA). The PIA is the benefit you are eligible to receive when you reach full retirement age (FRA).

The actual benefit you receive may not be your PIA. This is because your PIA will be increased or decreased depending on when you choose to receive benefits. Taking benefits before FRA will reduce your benefit, and waiting until after FRA will increase your monthly benefit. Also, starting at age 62, your eligible benefits will receive regular cost-of-living adjustments (COLA).

Married people are eligible for benefits based on their spouse’s work history. The spousal benefit is 50% of the working spouse’s earned benefit. In order to receive these benefits, the working spouse must be at least 62 and have already filed for benefits.

If you are divorced, you may also be eligible to receive spousal benefits based on your ex-spouse’s work history. Your marriage needs to have lasted at least 10 years, you must be divorced for at least two years, and you must still be single. In addition, you need to be at least 62 and not eligible for a higher benefit amount based on your own work record. Unlike spousal benefits for married people, your ex-spouse does not need to have filed for benefits in order for you to claim them.

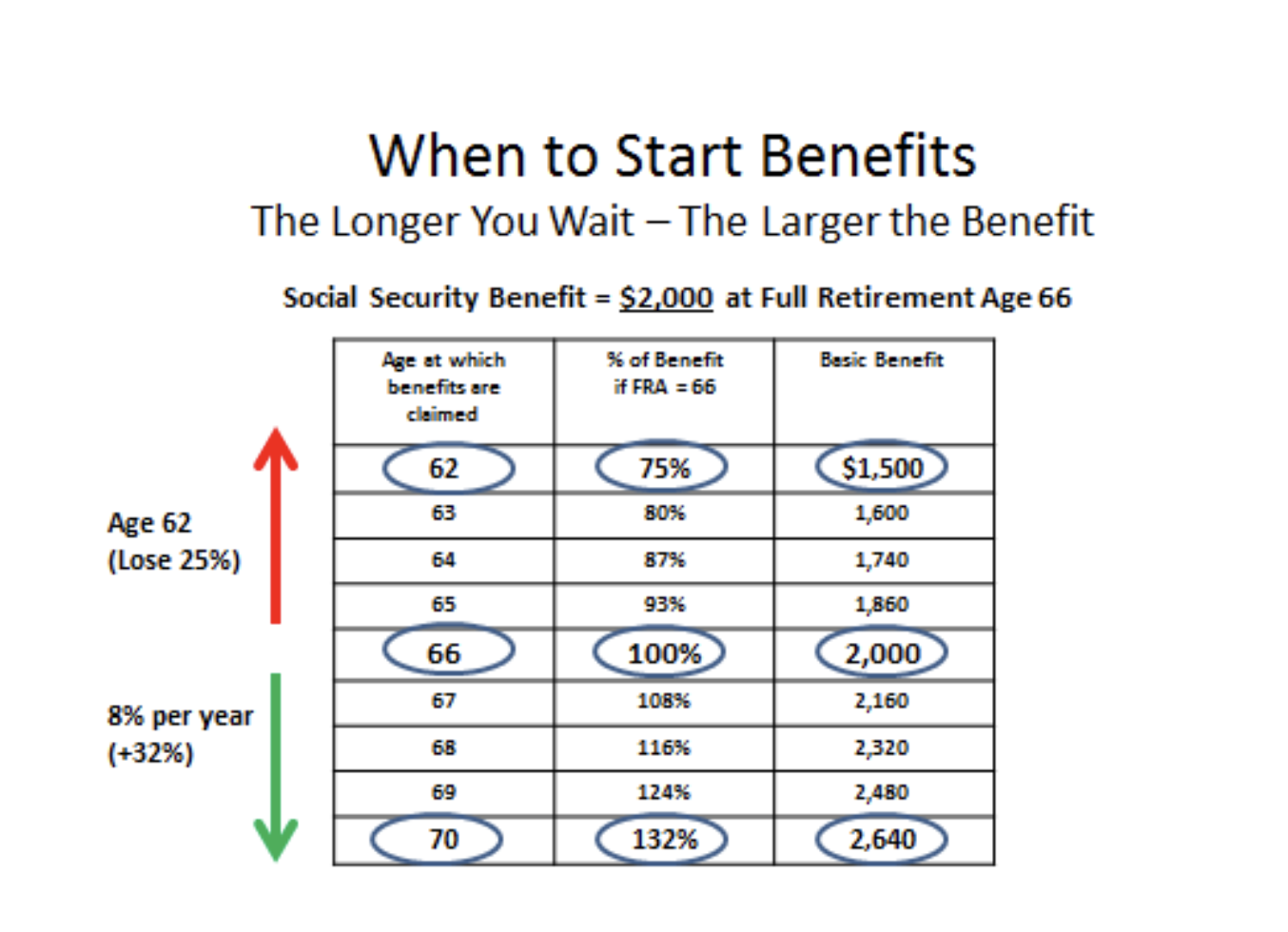

You can claim your Social Security benefits anytime between age 62 and age 70. If you continue to delay taking benefits after you reach age 70, there is no additional benefit increase. However, the age at which you choose to collect benefits before 70 will impact the amount of benefit you receive.

You can start receiving benefits as early as 62, but your monthly benefit will be lower than if you waited longer. Your basic benefit is reduced a fraction of a percent for each month you begin receiving benefits prior to full retirement age. Retiring early can permanently reduce your benefit by up to 30%.

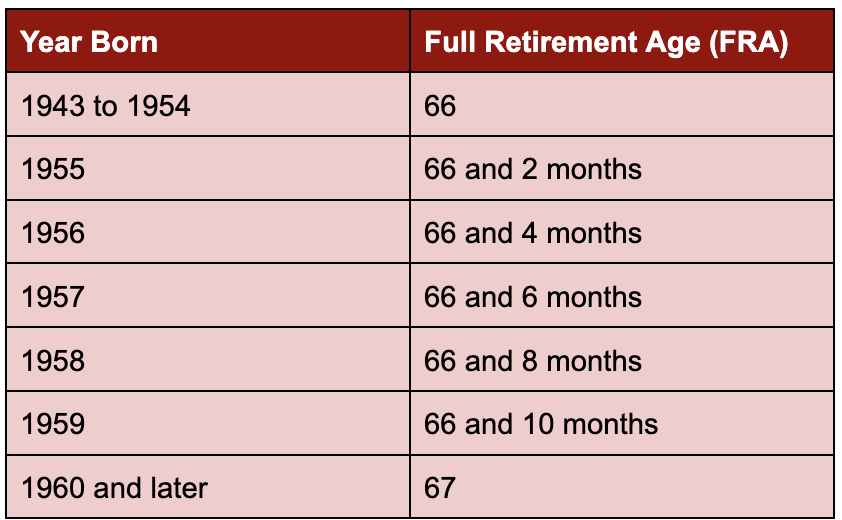

Your full retirement age (FRA) changes based on the year you were born. FRA is 66 for those born between 1943 and 1954 and increases by two months for every year after that you were born until it settles at age 67 for those born in 1960 or later. If you wait until you reach full retirement age to begin collecting your Social Security benefits, you will receive the full PIA that you have earned.

If you’re still working or don’t need the money immediately, you can delay receiving your benefits. Your benefit will increase by 8% for each year that you delay, with a maximum possible increase of 32%. You cannot delay and increase your benefit indefinitely, though. Once you reach age 70, the amount of benefits you receive will not increase any further.

While you are working, you can increase your future Social Security benefits by earning higher wages. Once you stop working, though, the only influence you have over your benefit is when you begin to take it. Your timing has a great impact on the amount of the benefit you will receive and should be carefully considered.

An important document that you will reference during the decision-making process is your Social Security statement. The Social Security Administration mails statements to workers age 60 and over who aren’t receiving Social Security benefits and do not yet have a my Social Security account. These statements will be mailed out three months prior to your birthday, but you can also access the same information by setting up an account on their website.

The statement will tell you your:

All benefit amounts listed are estimates and subject to change. They are calculated based on your date of birth and future estimated taxable earnings.

It is important to review your earnings history and check for accuracy. Your benefit is calculated based on those numbers, so any mistakes can affect your benefits. You should correct any errors as soon as possible.

Your Social Security benefits are calculated using complex actuarial equations based on life expectancy and estimated rates of return. They are not designed to encourage early or late retirement. If you live as long as anticipated, the total amount you receive over your lifetime should be about the same whether you claim it at age 62, age 70, or sometime in between. You will either receive the money as a smaller monthly payment over a longer period of time or a larger monthly payment over a shorter period of time.

The best time for you to claim your benefits depends on your personal situation and health. If you expect to live longer than average, your overall lifetime benefit will be greater if you delay claiming your benefits to increase your benefit amount. If the opposite is true and you see little chance of making it into your mid-80s, you would likely receive a greater lifetime benefit by taking it sooner, even though it would be a smaller monthly payment.

Once you decide when you want to start receiving benefits, remember to complete your application three months before the month in which you want your retirement benefits to begin.

Because married people have the ability to receive their own benefit or a spousal benefit, they have more to consider when filing for benefits. With the right strategy, married couples can potentially optimize their benefits.

In some cases, the lower-earning spouse may want to begin collecting benefits early while the higher-earning spouse waits as long as possible. That way, you can access the lesser benefit while waiting for the higher benefit.

Often, it is the husband with the higher benefit and the wife with the lower one. Women also tend to live longer than men. By following this strategy of waiting as long as possible to claim the higher benefit, you not only potentially optimize the husband’s retirement benefit for use while he is alive, but it also can utilize the wife’s survivor benefit when he passes away.

While it used to be a popular claiming strategy, the Restricted Application is now only available to those born before January 2, 1954. By restricting your application, you can receive a spousal benefit if your spouse is already collecting benefits while allowing your own benefit to continue to grow until age 70. That way, you can begin to receive spousal benefits while waiting on your own benefit.

Working does not affect your benefits once you reach FRA, but it does before that. Only earned income, such as wages and self-employment earnings, affects your Social Security benefits. Income from investments, pensions, and annuities do not affect Social Security benefits.

When you are under FRA for the whole year, your Social Security benefit is reduced by $1 for every $2 you earn over $21,240. In the year that you reach FRA, your benefit is reduced by $1 for every $3 you earn over $56,520. Once you reach FRA, your benefit is no longer reduced no matter how much you earn. These dollar amounts adjust each year, so your benefit may change in following years.

In 2023 the COLA is 8.7%, which is the biggest increase in 40 years. With this change, Social Security benefits increased by more than $140 per month. There is also an increase in the Social Security tax cap. The cap is increased from $147,000 to $160,200, meaning Social Security taxes will not be withheld from income earned above that amount.

This substantial increase in benefits will hopefully provide retirees some relief from the rising cost of goods and services. Historically, a COLA that fails to keep pace with inflation only serves to exacerbate financial hardships. It’s important to keep in mind that the COLA will affect pre-retirees and retirees differently. Here’s what to expect based on where you are in your retirement journey.

While this increase is good news for retirees, it’s not a license to change spending habits all that much—as most retirees know all too well.

It will still be necessary to keep track of your finances, spending—and, importantly, your tax liabilities; some beneficiaries could experience increased taxes in the coming years, depending on their thresholds.

Retirees who have not started claiming Social Security will still reap the benefits of this increase even if they don’t take Social Security this year. There is never a decrease in the COLA, so the higher payments are here to stay. Keep in mind that, in some cases, it’s worth holding off taking Social Security for several years once you’re eligible as discussed above. Of course, the benefits of doing so vary based on individual circumstances.

Your decision on when and how to claim your Social Security benefits can be the most critical retirement decision you make, depending on how much you have in savings. Due to the importance and intricacy of this decision, we highly recommend seeking the guidance of a financial professional before starting the process.

At Wealth Advocate Group, we can guide you through the complex Social Security process, empowering you to feel confident and ready for the next phase of life. If you’re approaching retirement and have inquiries about Social Security’s role in your overall financial plan, we’re eager to hear from you. Contact us by calling 440-505-5751 or emailing jcohen@Wadvocate.com to schedule an appointment.

Jason Cohen is Chief Operating Officer and wealth advisor at Wealth Advocate Group, LLC, an independent, fee-based wealth management company. Jason has 15 years of experience and spends his days managing firm operations, including portfolio trading and analysis, training of new advisors, financial plan production, and client relationship management. Jason specializes in serving real estate professionals and other independent contractor business owners, helping them navigate their unique financial challenges, such as unpredictable cash flow and tax issues, so they can pursue financial independence and freedom from worry. Jason has a bachelor’s degree in public management from Indiana University and is a CERTIFIED FINANCIAL PLANNER® professional and believes that everyone should have access to comprehensive financial planning. He is passionate about doing his best for his clients and setting others up for success. Outside of the office, you can find Jason staying active in a variety of sports and spending time with friends and family. Learn more about Jason by connecting with him on LinkedIn.

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.