Concerns about capital gains taxes are a good problem to have. You’ve made wise (or fortunate) investment choices, and now it’s time to reap the rewards. However, with profits come tax responsibilities. While death and taxes are inevitable, there are strategies you can use to reduce your tax burden effectively. Here are four tips to help you keep more of your hard-earned capital gains.

Timing the sale of your investments is critical to lowering your capital gains taxes. Selling your shares after holding them for less than a year will result in a short-term capital gains tax. This means that all the gains you made from the sale of the stock will be taxed at your ordinary income rate, which can be 32%-37% for high earners. Holding on to an asset for more than one year will be taxed at the long-term capital gains tax rate, which can be 0%, 15%, or 20% (depending on your tax filing status and taxable income).

Holding periods are also critical when it comes to the sale of real estate. If you sell your primary home and have lived in the home for at least two years of the five-year period before the sale, the IRS allows you to exclude the first $250,000 of capital gains (or $500,000 for a married couple filing jointly). While the capital gains exclusion does not apply to investment properties, you may be able to utilize 1031 (like-kind) exchanges to defer capital gains tax by reinvesting in other real estate.

A tax-loss harvesting strategy allows you to claim capital losses to offset your capital gains. If you show a net capital loss, you can use the loss to reduce your ordinary income by up to $3,000 (or $1,500 if you are married and filing separately). Losses above the IRS limit can be carried over to future years, allowing them to offset future realized capital gains. A tax-loss harvesting strategy can help minimize your tax liability and keep more money in your pocket. However, attempting to reduce taxes should not come at the expense of maintaining a thoughtful asset allocation in your portfolio.

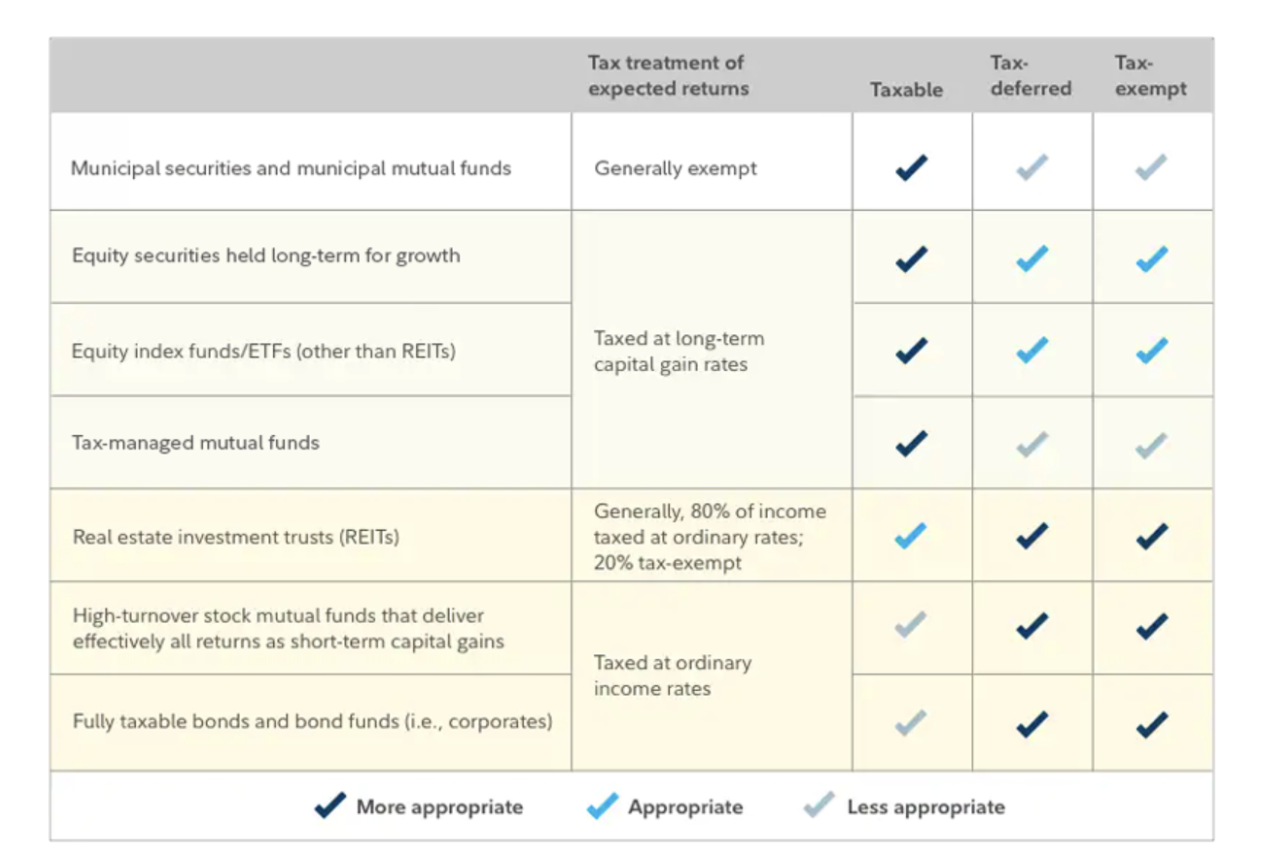

Some investments are more tax-efficient than others. For example, a municipal bond is considered the most tax-efficient security because income from municipal bonds are federally tax-exempt and may also be state tax-exempt for bonds issued in your state of residency. Investments such as corporate bonds are considered less tax-efficient because payments are not tax-exempt, meaning they are taxed as ordinary income. When looking at the table below, assets at the top are more tax-efficient than those at the bottom.

Source: Fidelity

Additionally, there are several types of investment accounts, each with different tax implications. Examples include individual and joint accounts, traditional IRAs, Roth IRAs, and qualified retirement plans such as a 401(k).

Pairing retirement accounts (IRAs, Roth IRAs, 401(k)s) with tax-inefficient assets and pairing non-retirement accounts (individual, joint, trust, etc.) with more tax-efficient assets will create a more optimal mix to minimize tax liability.

Of course, this is somewhat of an oversimplification as there are many nuances that can make certain investment vehicles more tax-efficient than others. This is why it is imperative to work with an experienced professional who can leverage the nuances of each financial instrument to your advantage.

When you purchase stock, the stock is assigned a lot number regardless of the number of shares. If you have made multiple purchases of the same stock, each purchase is assigned to a different lot number with a distinct cost basis (determined by the price at the time of each purchase). Consequently, each lot will have appreciated or depreciated by different amounts. Some brokerage accounts use first-in, first-out (FIFO) by default. If you utilize FIFO, your oldest lots are sold first. While FIFO can make sense in some situations, it’s not always the best strategy. In certain cases, it’s ideal to sell lots with the highest cost basis, which is commonly done as part of a tax-loss harvesting strategy..

Excluding annuities, transferring non-retirement assets to your beneficiaries at death will “step up” the cost basis to the fair market value (FMV) on the date of death. This one-time “step-up in basis” allows your heirs to pay long-term capital gains tax only on the growth that occurs above the date of death FMV.

Reducing capital gains taxes is just one piece of the puzzle when it comes to your overall financial health. Remember, owing capital gains taxes indicates that your investment strategies are yielding positive results.

At Wealth Advocate Group, we know that pursuing your financial objectives needs a comprehensive approach that considers all the various elements. Working with a financial advisor can help you design a plan tailored to meet your specific goals. To arrange a complimentary, no-obligation consultation, reach out to us by calling 440-505-5704 or emailing jbrown@Wadvocate.com.

John Brown is a wealth advisor at Wealth Advocate Group, LLC, an independent, fee-based wealth management company. With over 10 years of experience in the financial industry and a background in accounting, John provides sophisticated and specialized services to his senior executive clients who need the expertise of someone well-versed in concentrated securities and restricted stock strategies, as well as the risk and tax burdens that come along with their compensation. John has a bachelor’s degree in accounting and financial management from Hillsdale College and is a CERTIFIED FINANCIAL PLANNER® professional. John is known for his thorough approach, often asking questions and bringing up details his clients have not considered. He strives to address every piece of his clients’ financial picture to make sure they are on the path toward their goals and financial confidence. In his spare time, John and his wife, Christina, enjoy traveling and staying active. You can often find him spending quality time with his friends and family. To learn more about John, connect with him on LinkedIn.

When you link to any of the websites mentioned, we make no representation as to the completeness or accuracy of information provided at these websites. The opinions found therein are those of the author(s) of the article or website.