I’m sure we’ve all heard the phrase “Without risk, there is no reward.” But have you ever wondered just how much reward you should expect for taking a certain level of risk? Or how much risk warrants a certain level of reward?

Risk is a fact of life, especially when it comes to investing in the stock market. Overexposure to risk, however, is something that occurs when an investor is not properly analyzing their investment selections. So, how can you tell if you are taking uncompensated risk in your portfolio? The efficient frontier is a great place to start.

An investment concept first introduced by economist Harry Markowitz in 1952, the efficient frontier is one of the major pillars of modern portfolio theory (MPT), and it continues to inform many investors’ decisions today.

To understand the efficient frontier, it’s important to define several key terms first:

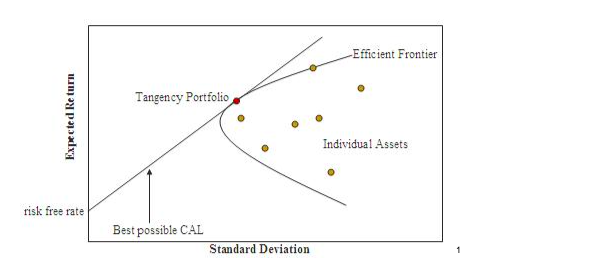

Based on these definitions, the efficient frontier consists of all the optimal portfolio combinations available based on the risk level an investor is willing to accept. It is a graphic representation of MPT and illustrates that adding more risk to a portfolio does not necessarily gain an equal amount of return.

If a portfolio lies below the efficient frontier, it is considered to have too much risk for its level of return. Conversely, if a portfolio lies above the efficient frontier, it has a greater return based on its level of risk. A portfolio that lies on the efficient frontier is considered perfectly balanced between risk and return.

A key component of MPT and the efficient frontier is understanding why certain portfolios with moderate levels of risk provide greater returns than portfolios with high levels of risk. Markowitz determined that this was because of diversification.

Not all assets or combinations of assets are created equal when it comes to the risk-return tradeoff. That’s why the efficient frontier appears curved. It illustrates that when a portfolio is properly diversified, it can produce higher levels of return for less risk and also shows that each subsequent degree of risk taken provides a diminishing level of return.

Optimal portfolios tend to have a higher level of diversification, while sub-optimal portfolios (those below the efficient frontier) tend to have less diversification.

The efficient frontier is important because it clearly illustrates risk versus return. Sometimes it can be difficult to know if you’re making the right choice when you invest in a certain asset. You can read the prospectus, crunch the numbers, and still find yourself second-guessing your decision.

Though the efficient frontier is not a perfect analysis tool, it does help investors visualize how much their level of risk is being compensated and thus it can be a great aid when making investment decisions. It can also help investors choose assets that will improve their overall diversification and bring their portfolio in line with the efficient frontier.

The efficient frontier can be used to select portfolios or specific investments tailored to an investor’s unique risk tolerance. Less risky assets fall to the left side of the curve while riskier assets fall to the right side.

Choosing along the efficient frontier can provide a balance between risk and return, while choosing below the frontier is considered suboptimal. An asset above the frontier is considered above average in return based on its level of risk. The efficient frontier can also be used to create a diversified portfolio of assets by choosing various investments along the curve.

As COO and Wealth Advisor at Wealth Advocate Group, I have over 15 years of experience managing portfolio trading and analysis utilizing concepts like MPT and the efficient frontier. I enjoy sharing this knowledge with my clients and helping the everyday investor understand the science behind sound investing advice. If you are interested in learning more about the technical side of our investment process, or you would like a second opinion on your current portfolio, call 440-505-5751 or email jcohen@Wadvocate.com to schedule an appointment.

Jason Cohen is Chief Operating Officer and wealth advisor at Wealth Advocate Group, LLC, an independent, fee-based wealth management company. Jason has 15 years of experience and spends his days managing firm operations, including portfolio trading and analysis, training of new advisors, financial plan production, and client relationship management. Jason specializes in serving real estate professionals and other independent contractor business owners, helping them navigate their unique financial challenges, such as unpredictable cash flow and tax issues, so they can pursue financial independence and freedom from worry. Jason has a bachelor’s degree in public management from Indiana University and is a CERTIFIED FINANCIAL PLANNER® professional and believes that everyone should have access to comprehensive financial planning. He is passionate about doing his best for his clients and setting others up for success. Outside of the office, you can find Jason staying active in a variety of sports and spending time with friends and family. Learn more about Jason by connecting with him on LinkedIn.

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

_________________